-

Asian Nutra Expansion: Joining the Profitable Digital Flow of India04.2.2021Reading Time: 9 minutes

Asian Nutra Expansion: Joining the Profitable Digital Flow of India04.2.2021Reading Time: 9 minutesWhat is India? It’s a vast territory of 32,87,263 sq. km, 36 geographical entities, and a large population ranked 2nd in the world’s population list (after China). Top it all off with the Digital India programme aimed at increasing Internet services, and we get a spicy CPA GEO that is a fruitful lead garden for affiliate Nutra campaigns.

Let’s have a detailed digital-angle look at India as a source of traffic for Nutra offers. Here’s a little task for you – while surfing the article, find out the list of offers to start the roaring Indian Nutra experience fast and easy (surely, in case you see all the benefits of the GEO!).

India in a nutshell

Biggest megalopolises: Mumbai, Delhi, and Bengaluru

Time zone: GMT + 05:30

Population: 1,388,225,942

- 35.0% of the population is urban (483,098,640 people in 2020)

- Life expectancy is 70.42 years

Languages: 17 major languages, 844 dialects. Hindi is the first official language followed by English, the secondary one

Religions: Hinduism (80%) and the Muslim (10%) with some Buddhists, Christians, Sikhs, Parsees, and Jains

Currency: Indian rupee (₹)

Per capita net national income 2020: 135 thousand rupees ($1851.142)E-commerce market

Expecting you this or not, but the revenue in the Indian eCommerce market is expected to reach $55,099 million in 2021.

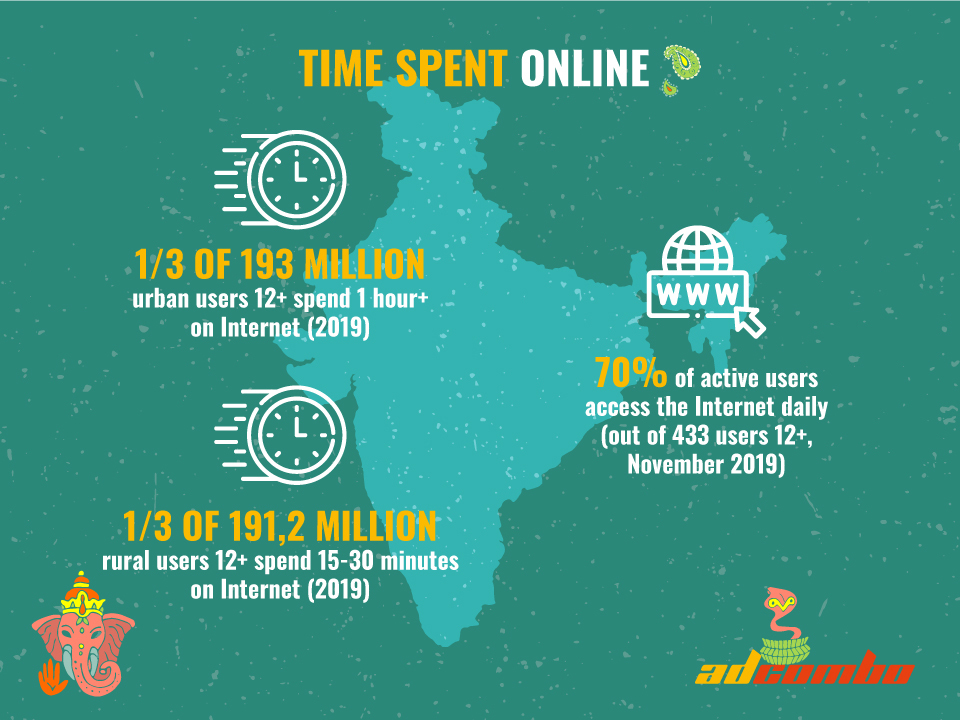

There are key propelling factors: increasing incomes of consumers and fast internet penetration, especially smartphone one. For August 2020, the total internet connections constitute 760 million with 61% connections from urban areas. Most of the rural parts have internet access as well.

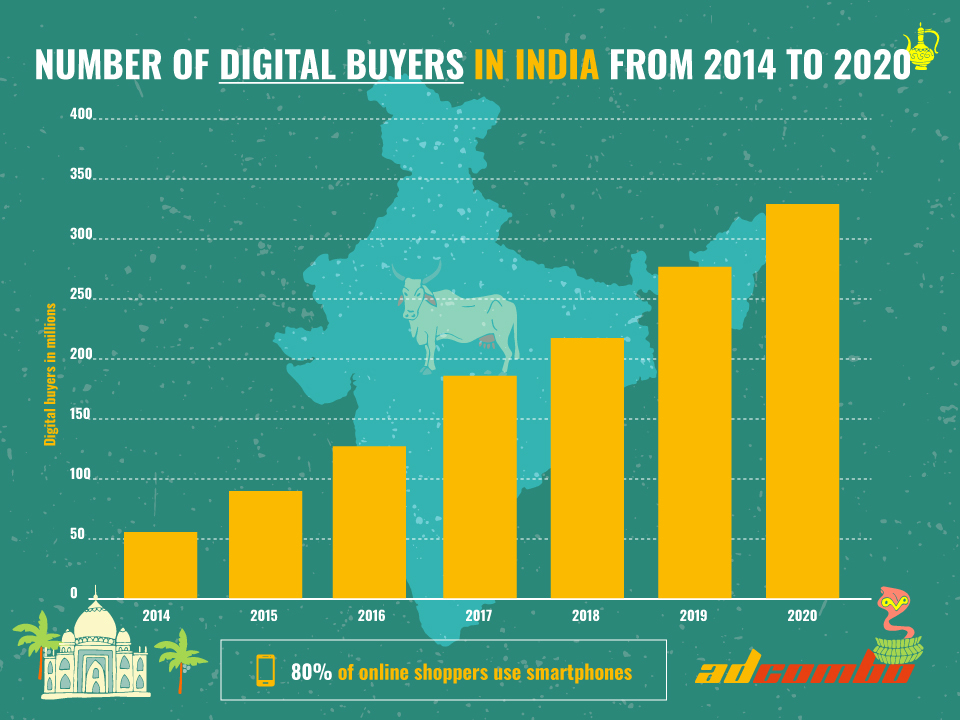

80% of online shoppers use their smartphones to make purchases and their number is increasing along with the number of mobile phone owners.

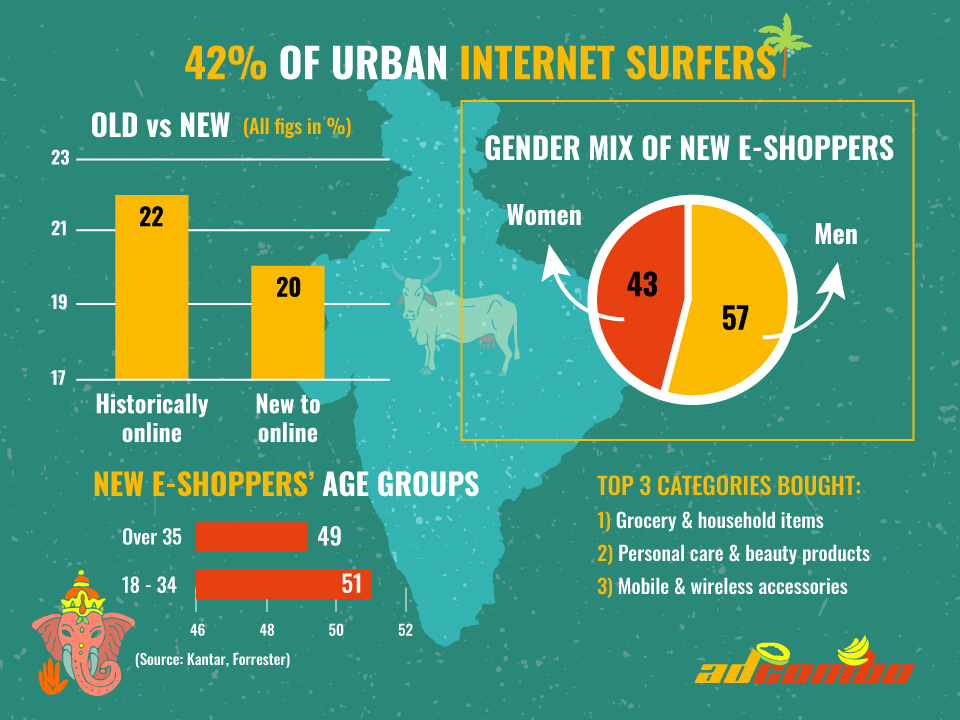

https://www.ecomkeeda.com/indian-ecommerce-market-trends/ Everyone remembers the hard pandemic 2020 that gave a new rise to online shopping, especially to some categories of goods including beauty products. India wasn’t an exception. The consumer pool has seen a two-fold increase over the initial three pandemic months of 2020 from 22% of active users to 42%, 50% of them came from Tier-1 (Chennai, New Delhi, Kolkata, Mumbai, and others) and Tier-2 (Ahmedabad, Surat, Pune, and Jaipur and others) Indian cities.

Let’s convert this into rough figures. Considering 329 million digital buyers detected in 2020, 22% of them were approximately 72.3 million internet users whose quantity increased up to 138.2 million (42%) later. 50% that came from large Indian cities translates to 69,1 million internet users.

6,000 people were surveyed on their shopping patterns in the last three months in July 2020 During the lockdown, the online sales statistics had a real blast as the Internet was the only source to make purchases. Moreover, most users still don’t want to reject the possibility of easy and convenient online shopping (generally speaking, the pandemic isn’t over yet), and this tendency keeps being up-to-date.

Want to try it out yourself right away? Take a look at these Beauty offers:

8286 Varikostop – IN (payout: $6, аpproval rate:48%)26123 Psolixir Cream – IN ($5.5, 36.40%)

6498 Goji cream – IN ($5.5, 30%)

Hint of AdCombo: Keep these regions in mind while targeting users. The following cities are recommended as the better ones for getting leads (based on our statistics):

📍 Delhi NCR

📍 Pune

📍 Thane

📍 Mumbai

📍 Bengaluru

📍 Hyderabad

📍 Lucknow

📍 Ahmedabad

📍 Surat

📍 Ludhiana

📍 Nagpur

📍 Ranchi

📍 Raipur

📍 Varanasi

📍 Raigarh(MH)

📍 Gorakhpur

📍 Durg

📍 Kanpur Nagar

📍 Vadodara

📍 Indore

📍 Kolkata

📍 Amritsar

📍 Chennai

📍 South Goa

📍 North Goa

E-commerce market trends

We recommend paying attention to the 3 Indian e-commerce trends when setting up campaigns:

- Mobile-friendly promotional material. Do you remember about 80% of users that do shopping via their smartphones? They should have clear access to your promotional content.

- Chatbots. Increase customers’ engagement and get more leads with the trend of 2019.

- Video ads. Cut the users’ scroll time for understanding your product’s nature and make them become interested in it.

Beauty & Personal Care market

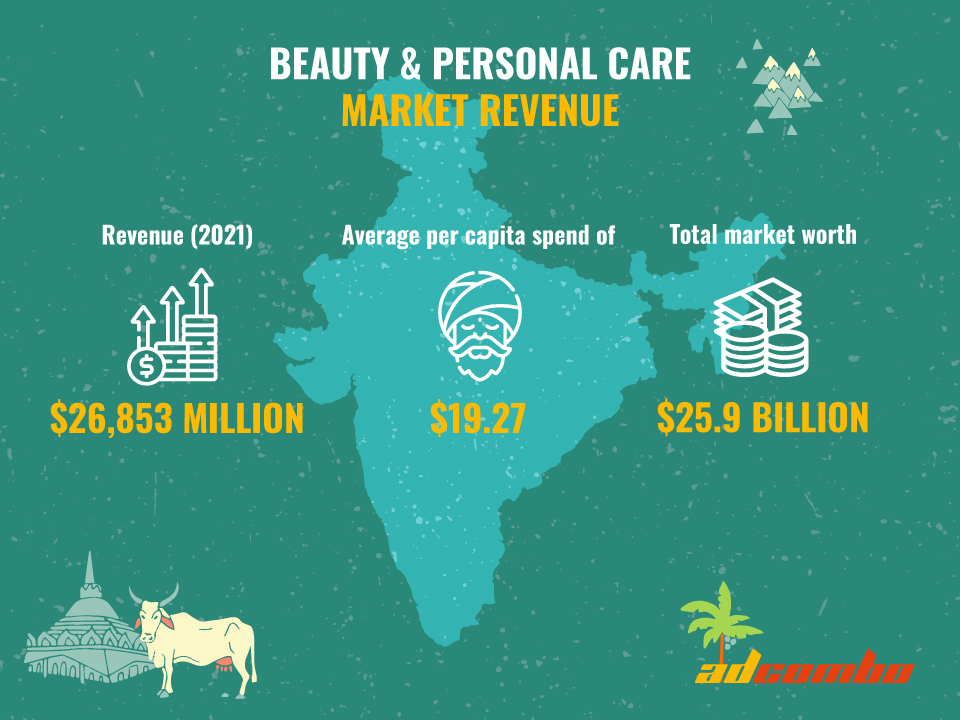

What does it consist of? Medical and pharmaceutical products, cosmetics, cleaning, care and beauty products, nutritions, and medical products like blood pressure monitors form this market segment. There are five key categories of cosmetics and beauty products: body care, face care, hair care, hand care, and color cosmetics.

The BPC market is supposed to get a $26,853 m revenue this year (2021) with an average per capita spend of $19.27. It converts into 48.74% of the overall Indian market revenue expected in 2021.

It is experiencing constant gradual growth and, for now, it’s estimated to be worth $25.9 billion. This isn’t the limit since the Indian shoppers’ per capita expenditures on beauty products are increasing with the sector’s growth. The BPC market is predicted to reach $32.7 billion by 2023 and occupy 46% of the overall Indian market.

There is no need to recall the offers that fall into the above-mentioned BPC groups, just click the fitting ones:

Health products

25522 Mycelix – IN (payout: up to $10, аpproval rate: 36.36%)

25526 Arthrazex – IN ($5.5, 32.38%)

20386 Gemoris Cream – IN (up to $10)Supplements

25523 Cardiovax – IN (payout: $5.5, approval rate: 35.41%)

25525 Mizzy – IN ($5.5, 28.43%)

23108 Proherbarium – IN ($5, 28.22%)

23106 iFocus – IN ($5.5, 26.46%)Face care

25615 Gialuronix gel – IN ($5.5)

Body care

2338 Green Coffee organic – IN (payout: $5.5)

21549 Cappuccino Fit – IN (up to $10)29451 Matcha Slim – IN ($ 5.5)Beauty & Personal Care market trends

And now let’s take a look at some trends of this marketing segment:

- Electronic payment methods. According to the survey held from Feb 2020 to Sep 2020, Indians prefer to pay mostly via credit cards for beauty and personal care product orders;

- Focus on mental and physical well-being. There is a strong tendency in India for buying natural, organic, anti-fatigue, antipollution, and anti-aging products;

- Feedback matter. The purchase decision for a certain product depends on other consumers’ reviews.

India goes on web

⬇️ Sources list

Source 1

Source 2

Source 3

Source 4

Source 5

Source 6Internet users’ peculiarities

The rural Internet popularity has almost caught up with the urban one in the number of active users due to the lasting digital expansion. Nevertheless, urban internet users are more likely to spend more time on Internet surfing. Indian women utilize the Internet less than males, and the gender gap, as of September 2019, is fairly wide in rural areas of India.

Note the following cities that have a high concentration of female users: Kerala, Tamil Nadu, and Delhi. Also, the older population evidently has a low level of Internet usage.Social Media, Mobile Apps & Websites usage (aka Indian traffic sources)

In 2020, WhatsApp led the top mobile traffic sources chart, having surpassed Facebook that was ranked second. 96% of Indians primarily utilize the app for daily communication.

WhatsApp had a pool of 400 million users from India in 2020 and implemented its payment platform approved by the National Payments Corporation of India (NPCI) in the country in February 2020. Facebook had 260 million active users all over India with a lot of traffic came from Mumbai, Delhi, and Bengaluru.

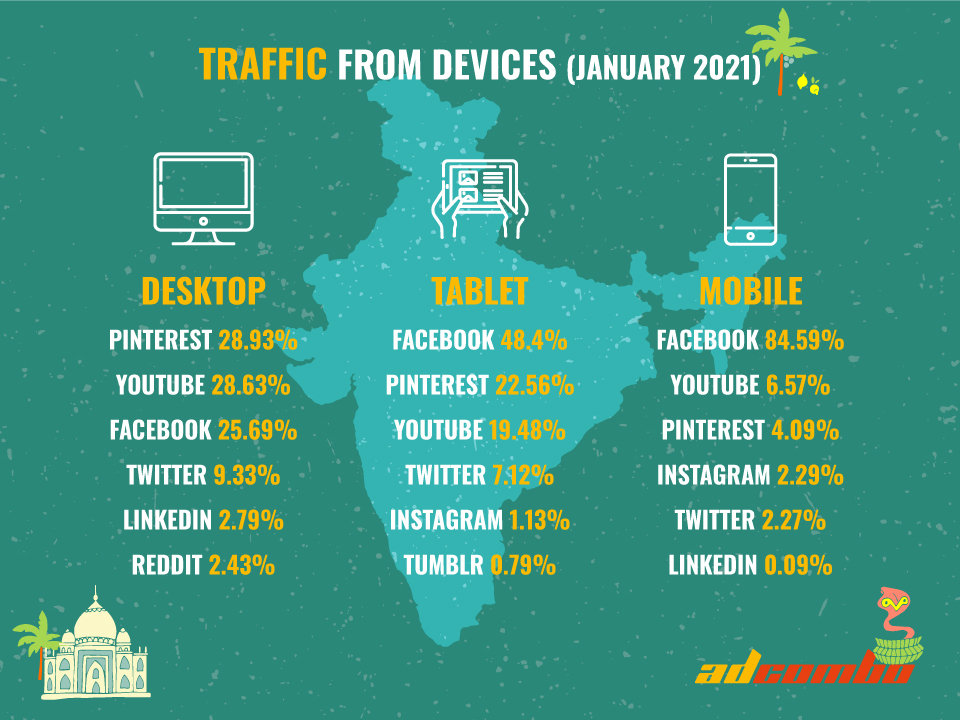

It’s needed to be noted that Instagram took 8th place despite being popular globally. At the start of 2020, Instagram had 80 million Indian people using it, most of them were youths aged 18-24.Let’s study the traffic charts of late. In January 2021 the following sites and figures were recorded:

https://www.similarweb.com/top-websites/india/

https://gs.statcounter.com/social-media-stats/all/india The statistic shows that generally the most Indian traffic came to:

- YouTube

- Google

So pick the traffic sources accordingly with the eye kept on types of traffic:

Facebook received mostly mobile and tablet traffic while desktop-traffic users preferred visiting Pinterest. The users of all traffic types favor YouTube that, as reported in January 2020, had 265 million active users across India. Here is one more mark: 95% of the YouTube content was both Indian and Bengali videos.

By the way, Pinterest can be a fine source of getting huge traffic even for free! Before your eyes start shining, we should make you understand that free traffic sources are usually overloaded which means you will face a feed of affiliate rivals there. Anyway, if you up for trying, we got a quite helpful article for you – CPA campaign without investments 2.0.

Taking-off Indian mobile traffic sources

Like experiments? We got 3 popular apps for getting extra Indian conversions. The following sources haven’t been studied and tried well enough yet, so you can be the trailblazer who will discover possible new traffic-flow paths free from affiliate peers.

Helo

Indian leading social platform with a database of 50 million users. They can create and follow fan pages as well as share content on various topics in 13 Indian languages like Hindi, Marathi, Tamil, Malayalam, and more.

Trell

It can be called video-format Pinterest. The app has been downloaded 10 million times. Trell is a social community for sharing lifestyle video content in local languages.

NB: the app isn’t available for foreigners, VPN is recommended.Vero

Not an Indian-made app but also popular with the locals. 1 million times the app has been downloaded in total. Vero has no ad-options and doesn’t use any algorithms for showcasing the content. The content can be shared with close friends, friends, acquaintances, and followers.Offers to start

Impatient for a campaign launch? We suggest you try the Nutra offers that tend to have high CR in our statistics charts. What’s more, there is a big variety of Nutra offers to choose from + all offers have high lead caps, and some of them go with payout bumps at request! Excellent? Let’s snatch them up!

Offers with high average approval rate:8286 Varikostop – IN (payout: $6, аpp.rate:48%)

26123 Psolixir Cream – IN ($5.5, app.rate:36.40%)

25522 Mycelix – IN(аpp.rate: 36.36%) → increased payout $10

25523 Cardiovax – IN($5.5, аpp.rate:35.41%)

25526 Arthrazex – IN ($5.5, аpp.rate:32.38%)

6498 Goji cream – IN ($5.5, аpp.rate:30%)

25525 Mizzy – IN ($5.5, аpp.rate:28.43%)

23108 Proherbarium – IN ($5, аpp.rate:28.22%)

23106 iFocus – IN ($5.5, аpp.rate:26.46%)

Other popular converting offers:21172 Gemoris Caps – IN (payout: $6)

20386 Gemoris Cream – IN → increased payout $10

2338 Green Coffee organic – IN ($5.5)

28307 Pine Pollen – IN → increased payout $10

27833 Detox Lungs – IN ($5.5)

27831 Immuno Boost – IN ($5.5)

25615 Gialuronix gel – IN ($5.5)

21549 Cappuccino Fit – IN → increased payout $10

29669 Toxic OFF – IN ($5.5)

29451 Matcha Slim – IN ($5.5)

NEW offer

30434 Biolactonix – IN ($5.5)Watching out for a strategy

Converting offers are part of success of promoting offers in India. The other part stands for the right strategy, or, the ways on how to get the Indian audience impressed.

🔴 Red-light images

First, it’s very important to determine what pics must be eliminated from your creative ideas.

- National flag

- Photos of healthcare specialists

🟡 Yellow-light images

Yeah, there is such a kind of photos. What to do with it? The snaps below are allowed, but they mustn’t be insulting or gravely violate laws or policies.

We don’t give advice, we’re just telling you about a possible option of using them.- Hindu Goddesses

- Sacred Animals

- Celebrities (btw, Indians tend to greatly rely on their endorsement of a brand)

🟢 Green-light images

The snaps of this type are allowed in advertising and, what’s more, recommended being used in it:

- Local or South Asian people

Creative-making techniques

You know perfectly that motivational CTA works its excellent results. A text put in your creative can make your would-be lead stick to an ad or bounce off it. This also concerns the rest elements of a creative. Look through some useful techniques for designing your creative material for the Indian market.

- Promotional claim. “Buy 1, get 1” – which means a customer will get an extra item after buying the same one;

- Public experience. “Hundreds of customers have already seen the effect”, why don’t a user become a happy customer too?

- Bright colors. Use them to drag Indians’ attention;

- Facts or Figures. “– 10 years/kilos with/in …” They can be persuasive only when they are rational;

- Deceiving yet nice statement. “No wrinkles in 1 minute”. Although everyone understands that it’s false, people get the main idea of your product at once;

- Life involvement. Your ad should give solutions to the common people’s problems at the first touch;

- Metaphorical solution. Sometimes it’s better to give a clue to a solution in an imaginary or even a bit funny way.

Sum up

Wide audience coverage possible thanks to the digitalization that India has been experiencing for 5 years, the growing Beauty and Healthcare market, many new users started shopping online make India the sweet territory to step in for collecting leads.

Affordable ad cost makes it even sweeter! Why wait? Grab the offers and discover Indian GEO beyond the article (but with the help of it)!

Leave your comment